For many people, the idea of suing a professional—be it a solicitor, surveyor, or accountant—can seem daunting. Yet, as the courts in England and Wales continue to clarify the law, individuals representing themselves (“litigants in person”) are better equipped than ever to navigate these complex claims. Here’s what you need to know in 2025, including the latest legal developments and practical steps to take.

Understanding the Basics: What Is Professional Negligence?

Professional negligence occurs when a professional fails to perform their duties to the standard expected, causing you financial loss. Contract claims, meanwhile, arise when a professional fails to deliver what was agreed in a contract. Both types of claims share common ground, but the legal route you choose can affect your chances of success, the damages you can recover, and the time you have to bring your case.

The Legal Framework: What Has Changed?

The law in this area is shaped by both longstanding principles and recent court decisions. In 2025, two cases in particular have sharpened the focus for claimants:

- The Court of Appeal’s decision in Amtrust Specialty Ltd v Endurance Worldwide Insurance Ltd [2025] EWCA Civ 755 clarified how professional indemnity insurance policies are interpreted, especially when it comes to what is and isn’t covered.

- The High Court’s ruling in Roger Leggett & 40 Others v American International Group UK Ltd [2025] EWHC 278 (Comm) set out how and when insurers must pay out on professional negligence claims.

These cases build on established authorities such as Manchester Building Society v Grant Thornton UK LLP [2021] UKSC 20 , which remains the touchstone for understanding the “scope of duty” owed by professionals.

Step-by-Step: Bringing Your Claim

1. Identify the Duty and the Breach

You must show that the professional owed you a duty of care (either under contract or in tort), that they breached that duty, and that you suffered loss as a result. The courts will look closely at the contract or retainer letter, the nature of the advice or service, and whether the loss you suffered was the kind the professional was supposed to protect you from.

2. Prove Causation and Loss

Not every mistake leads to compensation. You must prove that the professional’s error caused your loss, and that the loss falls within the “scope of duty” as clarified by Manchester Building Society v Grant Thornton UK LLP [2021] UKSC 20 . If the loss would have happened anyway, your claim will likely fail.

3. Check the Limitation Periods

Time is of the essence. Most claims must be brought within six years of the breach or loss ( Limitation Act 1980 ). If the damage was not immediately obvious, you may have three years from when you discovered it, but there is a strict 15-year longstop. Missing these deadlines usually means your claim cannot proceed.

4. Consider Professional Indemnity Insurance

Most professionals are required to carry insurance. The recent Amtrust Specialty Ltd and Roger Leggett cases highlight that whether an insurer will pay depends on the exact wording of the policy and the timing of your claim. If the professional is insolvent, you may be able to claim directly against their insurer—but expect insurers to scrutinise the details.

5. Prepare Your Case

Gather all relevant documents: contracts, emails, advice, and evidence of your loss. If you cannot settle, you’ll need to issue a claim form and set out your case clearly, including the duty owed, the breach, how it caused your loss, and why the loss is recoverable.

Key Authorities to Know

- Manchester Building Society v Grant Thornton UK LLP [2021] UKSC 20 (scope of duty and recoverable loss)

- Amtrust Specialty Ltd v Endurance Worldwide Insurance Ltd [2025] EWCA Civ 755 (insurance coverage)

- Roger Leggett & 40 Others v American International Group UK Ltd [2025] EWHC 278 (Comm) (insurer liability)

- Limitation Act 1980 (time limits for claims)

Practical Tips for Litigants in Person

- Be precise: Clearly identify the professional’s duty and how it was breached.

- Act quickly: Diarise limitation dates and don’t delay.

- Check insurance: If the professional cannot pay, investigate their insurance position.

- Be realistic: Not all losses are recoverable—focus on those directly linked to the breach and within the professional’s scope of duty.

- Get help if needed: While you can represent yourself, complex cases may benefit from legal advice, especially where insurance or limitation issues arise.

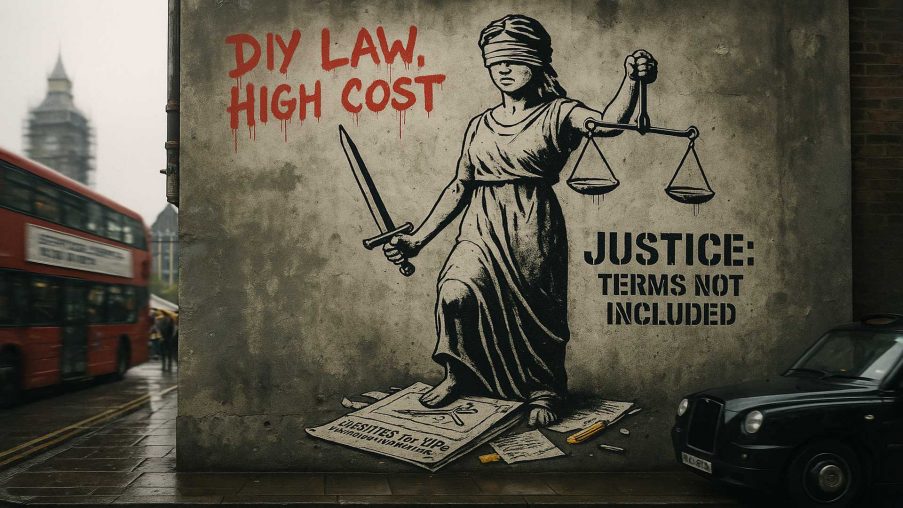

The Bottom Line

The law on professional negligence and contract claims is evolving, with recent cases in 2025 providing greater clarity—especially on insurance and the scope of recoverable losses. For litigants in person, understanding these developments is crucial. With careful preparation and attention to the latest guidance, individuals can navigate the process and seek redress when professionals fall short.

This article is for general information only and does not constitute legal advice. Every case turns on its own facts and evidence. If in doubt, seek professional legal assistance.

Thanks very much for your guildes and support in regards to Professional Negligence and conduct,

Kind Regards, Dara.

I am in the process of dealing with deceits and a biased settlement agreement very much in favour of the defendant, these documents are mainly confidential so can not be shared but I would value an impartial opinion on the latest settlement agreement which curtails my Human rights to freedon of thought and expression